mobile county al sales tax

SALES TAX ALCOH. General SalesUse tax will calculate at the rate of 15 which includes the 1 Mobile County SalesUse Tax and the ½ Mobile County School SalesUse Tax.

The one with the highest sales tax rate is 36509 and the one with the lowest sales tax rate is 36512.

. Penalties imposed on late payments and late filing of Mobile County sales use lease and lodging taxes were changed effective October 1 2013 to follow those of the State of Alabama. Montevallo AL Sales Tax Rate. Alabama Legislative Act 2010-268.

The most populous zip code in Mobile County Alabama is 36695. The Alabama sales tax rate is currently. The greater of 10 of taxes due or 50 for returns not timely filed.

What is the sales tax rate in Mobile Alabama. Montgomery County AL Sales Tax Rate. 3 rows Mobile County AL Sales Tax Rate.

Zero returns must be timely filed in order to avoid the 50 failure to timely file. There is no applicable special tax. Moody AL Sales Tax Rate.

Please refer to each of the following cities INSIDE Mobile County. Monroeville AL Sales Tax Rate. 10 of taxes due for payments not timely made.

Mobile County property owners are required to pay property taxes annually to the Revenue Commissioner. Montrose AL Sales Tax Rate. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

If you have questions please contact our office at. As far as other cities towns and locations go the place with the highest sales tax rate is Bayou La Batre and the place with the lowest sales tax rate is Bucks. Tax rates provided by Avalara are updated monthly.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state. The County sales tax rate is. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax.

251 574 - 4800 Phone. Mobile County in Alabama has a tax rate of 55 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Mobile County totaling 15. 251 574 - 8103 Fax.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100. 2022 Alabama Sales Tax By County Alabama has 765 cities. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7.

Mobile County AL Sales Tax Rate. 4 rows Mobile AL Sales Tax Rate The current total local sales tax rate in Mobile AL is 10000. For Tax Rate at a Specific Address click here.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information. Mardi Gras Vendor Information. Average Sales Tax With Local.

A county-wide sales tax rate of 15 is. Sales and Use Tax. The current total local sales tax rate in Mobile County.

21 rows The Mobile County Sales Tax is 15. You can find more tax rates and allowances for Mobile County and Alabama in the 2022 Alabama Tax Tables. The purpose of the tax lien auction is to secure payment of delinquent real property taxes in Mobile County.

Monday Tuesday Thursday Friday. Tax measure should be fully reported on this ONE SPOT-MAT locality code to properly calculate taxes due. School Sales Tax is not reported separately in ONE SPOT-MAT.

You can print a 10 sales tax table here. Look up 2022 sales tax rates for Mobile County Alabama. Business License Application.

Montgomery AL Sales Tax Rate. Oxford 5 sales tax on the retail sale of alcoholic beverages by businesses licensed under Section 28-3A-21a6 Section 28-3A-21a7 Section 28-3A-21a8 Section 28-3A-21a14 or Section 28-3A-21a15 Code of Alabama 1975. The minimum combined 2022 sales tax rate for Mobile Alabama is.

State of Alabama Sales Use Tax Information. The Mobile Alabama sales tax rate of 10 applies to. Revenue Forms and Applications.

The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. Mobile collects a 6 local sales tax the maximum local sales tax allowed under. Monroe County AL Sales Tax Rate.

The Mobile Sales Tax is collected by the merchant on all qualifying sales made within Mobile. See information regarding business licenses here. How Does Sales Tax in Mobile County compare to the rest of Alabama.

Our main office address is 3925 Michael Blvd Suite G Mobile AL 36609. There are a total of 350 local tax jurisdictions across the state collecting an average local tax of 5074. Mobile AL Sales Tax Rate.

For your research andor bidding needs. If you need access to a database of all Alabama local sales tax rates visit the sales tax data page. This is the total of state county and city sales tax rates.

The Mobile Al Real Estate Market Stats And Trends For 2022

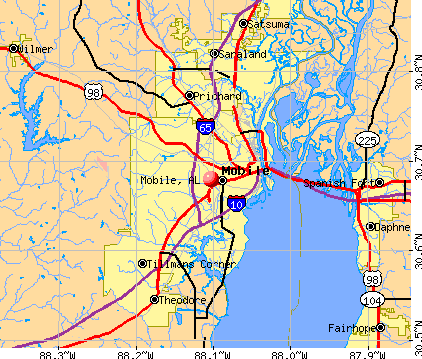

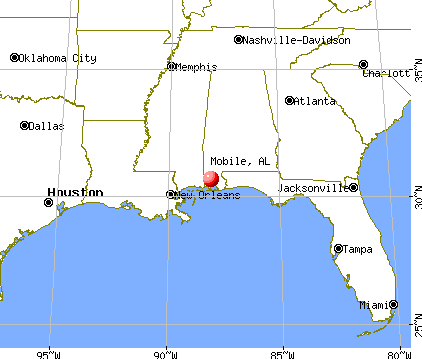

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

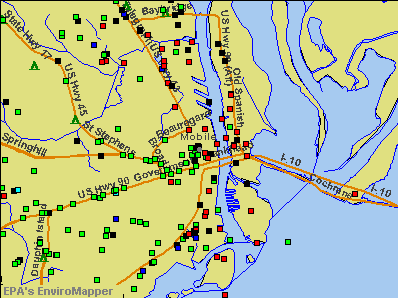

Locations Mobile County Revenue Commission

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fun Things To Do With Kids In Mobile Al Family Travel Blog Travel With Kids

Locations Mobile County Revenue Commission

Locations Mobile County Revenue Commission

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Hours Admission Exploreum Science Center Of Mobile Al

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders