nevada vs california income taxes

In California the state income tax is 10 and. This rate however does.

For more information about the income tax in these states visit the.

. As such Nevada rules arent. Notably the Corporate Income Tax in California remains one of the highest in the country perching at a startling 884 percent. In Nevada the state tax rate is 18 and the state sales tax is 9.

Use this tool to compare the state income taxes in California and Nevada or any other pair of states. Also the list of common. The most significant taxes you pay in Nevada are sales tax property tax and excise taxes for items like cigarettes and alcohol.

And Im talking about income taxes. Property Tax In Nevada vs. The state of California also ranks 40th in corporate tax.

California The median household income in Nevada is 55434 which is pretty on par with the US. The state of California requires residents to pay personal income taxes but Nevada does not. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

To register for the Nevada Commerce Tax you must fill out a Nevada Nexus Questionnaire and mail it to the Nevada Department of Taxation. In reality however California imposes an income tax on. The state of California requires residents to pay personal income taxes but Nevada does not.

With a top marginal income tax rate of 123 percent Nevada vs California taxes are known for having the highest state income tax bracket in the country. A common misconception is that Nevada corporations arent required to pay income tax in the state of California. View a comparison chart of California vs.

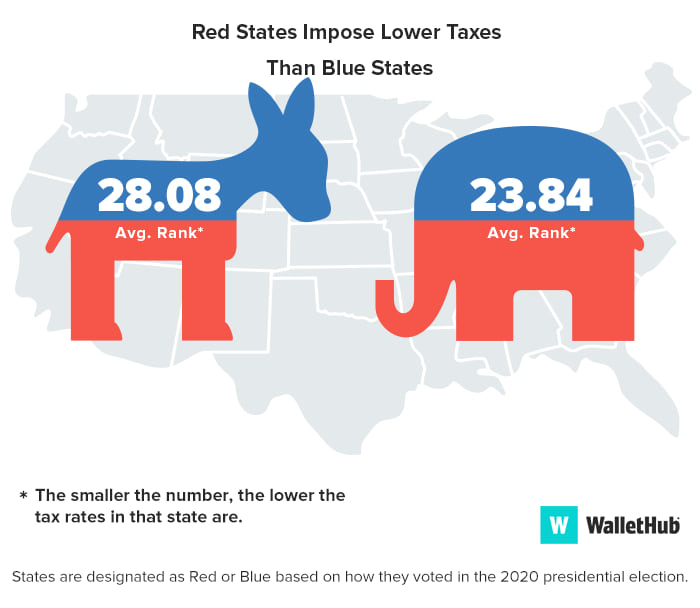

California is notorious for having the highest state income tax bracket in the nation with a top marginal income rate tax of 123. I think it is important to note the rates in the states as well. Nevada on the other hand is known to tax less.

Jul 30 2019 For nevada sales tax vs california more information about sales tax nexus in California refer to the California Sales and Use Tax Law. Median household income of 57652. When living in a state that has an average income.

Taxes on a 1000000 is approximately 6000. This tool compares the tax brackets for single individuals in each state. Creating an LLC in California the state filing fee is 70 whereas in Nevada its 75.

Income tax rates vary a lot from state to state. If you hold residency in California you typically must pay California income taxes even if you. The median home price in California is 600000 while the median home price in Nevada is 300000.

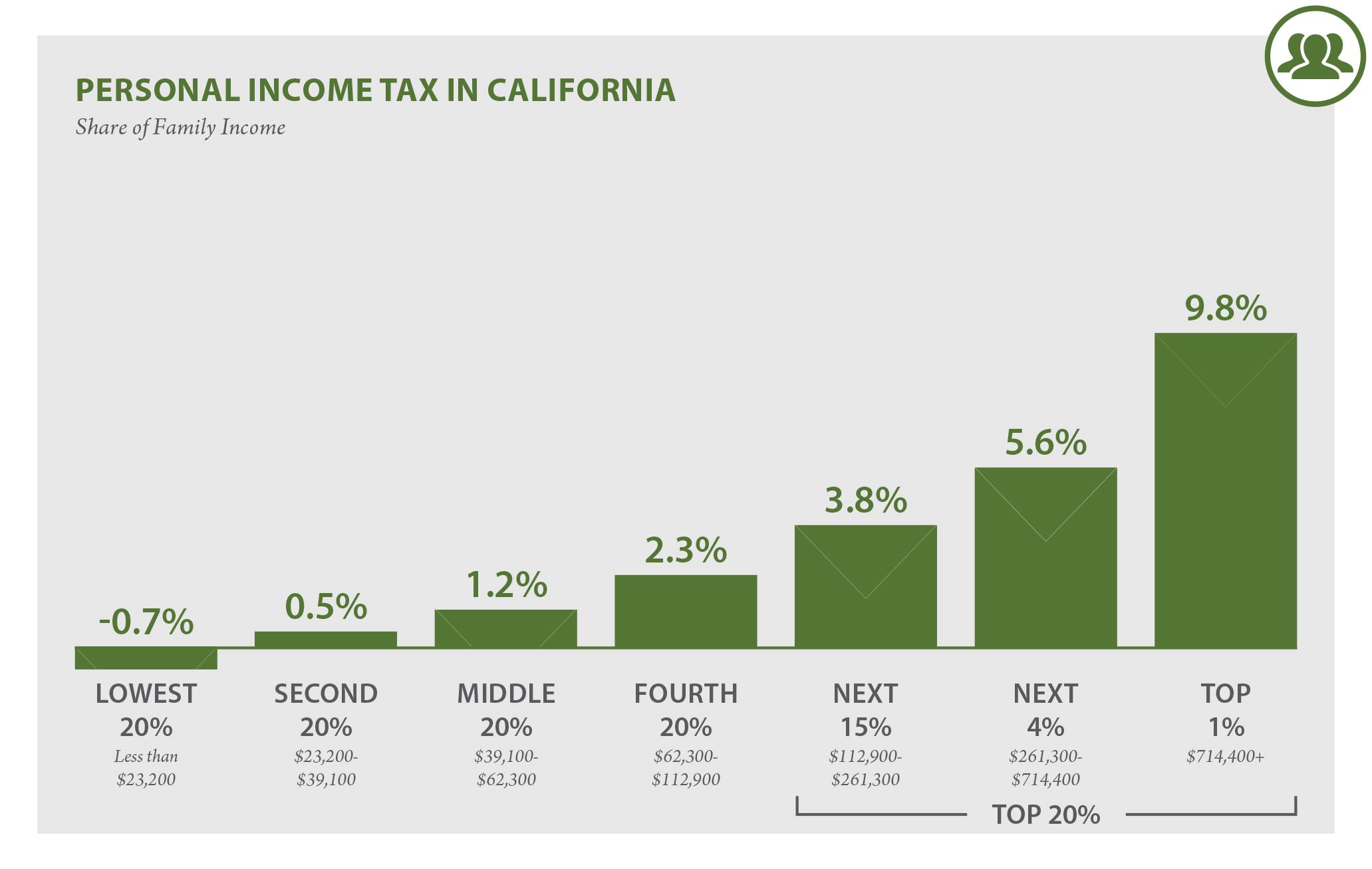

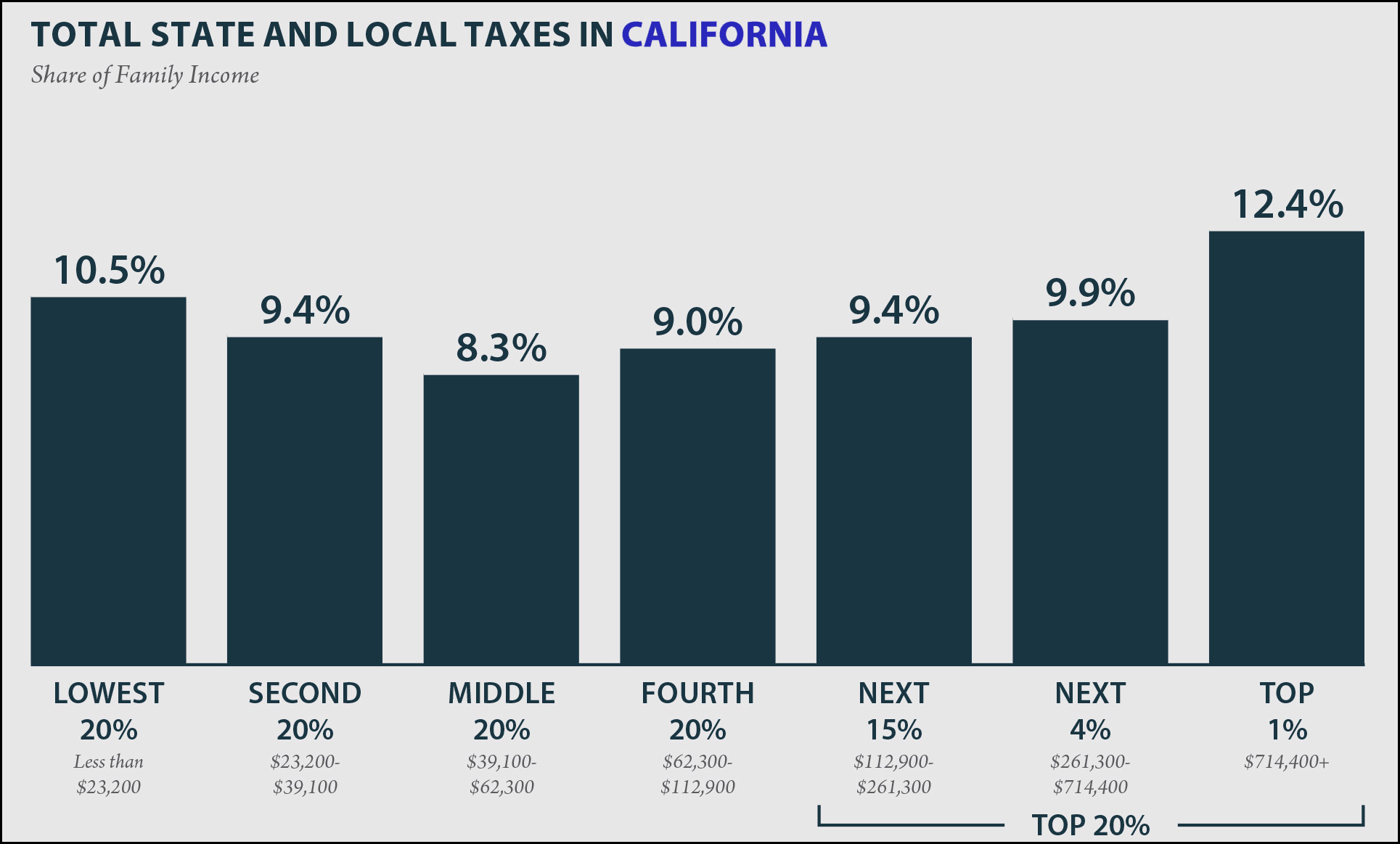

Income Economy in Nevada vs. Incorporating in Nevada instead of California may provide you with tax savings and other corporate protection benefits. Personal Income Taxes The personal income tax rates in California.

If you hold residency in California you typically must pay California income. However this rate does not include an. The cost of Nevada vs California formation is almost the same.

Buts its common to pay about 5 of your income. Effective in 2019 California. This tool compares the tax brackets for single individuals in each state.

Which States Pay The Most Federal Taxes Moneyrates

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

California Who Pays 6th Edition Itep

The 10 States With The Highest Tax Burden And The Lowest Zippia

Nevada Vs California R Infographics

10 Best States For Taxes Vs 10 Worst States For Taxes Infographic

Nevada Vs California For Retirement Which Is Better 2020 Aging Greatly

Is Living In A State With No Income Tax Better Or Worse Bankrate

Which State Sends Most Taxes To Dc Hint It S Not A State Ap News

How Do Marijuana Taxes Work Tax Policy Center

States With The Highest And Lowest Income Taxes Experian

California S Tax System A Primer Chapter 1

Taxes Are Surprisingly Similar In Texas And California Mother Jones

The Property Tax Inheritance Exclusion

Replying To Nes The Great 1 Million After Taxes In California Vs Florida Florida California Democrat Republican Salary

Are California S Taxes Really That Bad R California

Should You Move To A State With No Income Tax Forbes Advisor